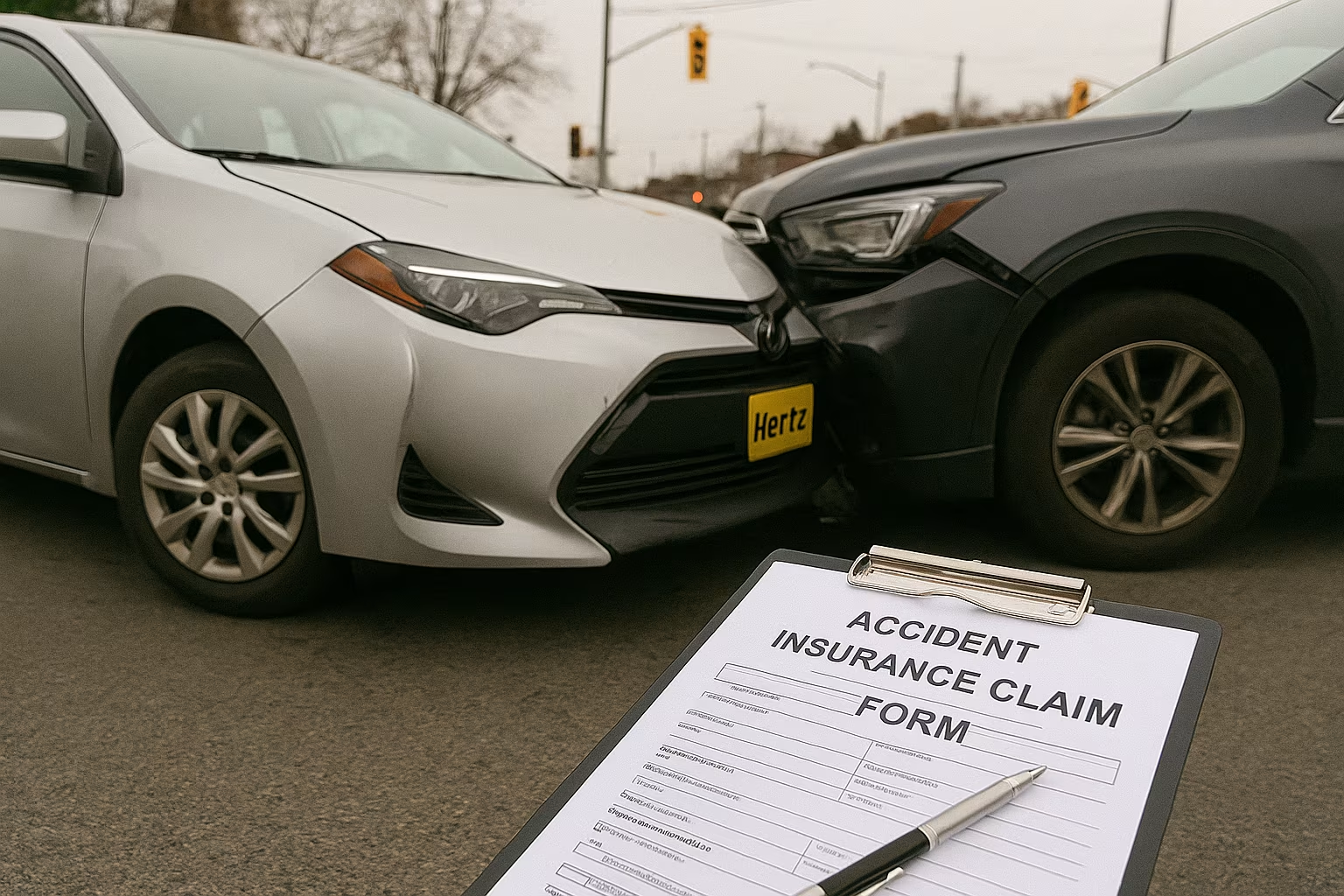

The Hidden Complexity of Rental Car Crashes

Most drivers assume rental car accidents work just like regular crashes. Then they discover multiple insurance companies pointing fingers while bills pile up.

Texas rental car accidents create a unique legal maze where your personal insurance, rental coverage, credit card benefits, and the other driver’s policy all collide in confusing ways that leave victims stranded.

Why Rental Car Accidents Are So Complicated in Texas

Unlike typical crashes, rental car accidents involve layers of insurance coverage that overlap, contradict, and often exclude the very protection you need most.

The rental company’s collision damage waiver might cover the vehicle but leave you exposed to liability claims, while your credit card coverage could vanish the moment you discover it excludes Texas commercial rentals or luxury vehicles.

Insurance companies exploit this confusion by deflecting responsibility, forcing victims to navigate between multiple claim departments while each insurer searches for reasons to deny coverage.

Understanding your Texas insurance coverage becomes even more critical when rental agreements and federal laws like the Graves Amendment shield rental companies from most lawsuits.

Angel Reyes & Associates has guided countless clients through this insurance maze, uncovering coverage that other attorneys miss and forcing insurers to honor their obligations.

We know exactly how these companies operate and which strategies transform denied claims into full compensation.

What Insurance Might Apply in a Texas Rental Car Accident?

The question of coverage after a rental car accident often has four different answers, each with its own limitations and exclusions.

Understanding how these policies interact and conflict determines whether you receive fair compensation or get caught in endless insurance disputes.

1. Your Personal Auto Insurance

Your personal auto policy often extends to rental cars, but the coverage might be secondary unless you specifically declined the rental company’s insurance at the counter.

Many drivers discover too late that their policy includes rental vehicles only for liability, leaving them personally responsible for damage to the expensive rental car itself.

2. The Rental Car Company’s Insurance (CDW/LDW)

Collision Damage Waiver sounds comprehensive but typically covers only damage to the rental vehicle, not your liability to others you might injure.

This coverage can be voided instantly by contract violations like allowing an unauthorized driver behind the wheel, leaving you completely exposed when you thought you were protected.

3. Your Credit Card Benefits

Credit card rental coverage often requires you to decline all rental company insurance and pay the entire rental with that specific card.

Even then, most cards provide only secondary coverage that excludes liability claims, luxury vehicles, and commercial use. These limitations only surface after an accident occurs.

4. The At-Fault Driver’s Insurance (Third-Party)

When another driver causes your rental car accident, their liability insurance should cover your damages under Texas’s fault-based system.

However, these insurers frequently dispute claims involving rental vehicles, arguing about coverage gaps or trying to shift blame when determining who’s liable in a car accident.

Common Rental Car Accident Scenarios in Texas

Each rental car accident scenario creates unique insurance challenges that catch unprepared drivers off guard. Recognizing your situation helps you understand which coverage applies and what legal rights protect you from financial disaster.

You Caused the Crash in a Rental Car

If you’re at fault, your personal liability insurance might cover damages to others, but Texas’s minimum 30/60/25 requirements often fall short in serious accidents.

Without purchasing the rental company’s collision damage waiver, you could face thousands in rental car repair bills that neither your insurance nor credit card will cover.

Someone Else Hit You While You Were Driving a Rental

Being the victim doesn’t guarantee smooth sailing when insurance companies start disputing who pays for rental car damage versus your injuries.

The at-fault driver’s insurance should cover everything, but rental companies often pressure you for immediate payment while these claims drag on, creating financial stress during your recovery.

You Loaned the Rental to Someone Not Listed on the Contract

Letting your spouse or friend drive might seem harmless until an accident voids all coverage because they weren’t authorized on the rental agreement.

This common mistake leaves you personally liable for all damages, transforming a helpful gesture into a financial nightmare when understanding why basic coverage isn’t enough.

You Were a Passenger in a Rental Vehicle Crash

Passengers in rental car accidents often have the clearest path to compensation, with multiple insurance sources potentially available including the driver’s policy and your own PIP coverage.

However, determining which insurance pays first and navigating car accident claims for passengers still requires understanding Texas law and insurance priorities.

Texas-Specific Laws That Affect Rental Car Accident Claims

Texas law creates specific challenges for rental car accident victims that differ significantly from other states.

Understanding these legal frameworks helps you avoid common pitfalls that insurance companies exploit to minimize or deny claims.

Minimum Liability Coverage (30/60/25 Rule)

Texas requires drivers to carry $30,000 per person, $60,000 per accident for bodily injury, and $25,000 for property damage. These amounts seem substantial until a serious rental car accident occurs.

And minimums often leave victims undercompensated, especially when medical bills and rental car damage quickly exceed these limits.

Comparative Fault Rule (Modified – 51%)

Texas’s modified comparative fault rule means being found 51% or more at fault completely bars you from any recovery, making fault determination crucial in rental car accidents.

Insurance companies aggressively push fault percentages, knowing that tipping you over 50% saves them from paying anything. That makes understanding filing a claim when partially at fault essential.

The Graves Amendment

This federal law shields rental car companies from vicarious liability in most accidents, meaning you generally cannot sue Enterprise, Hertz, or other rental agencies just because they owned the vehicle.

Unless the rental company was negligent in maintenance or violated safety regulations, your legal claims must focus on the at-fault driver rather than the deep-pocketed rental corporation.

The Most Common Rental Car Insurance Pitfalls in Texas

Smart drivers still fall into insurance traps that transform minor rental car accidents into major financial burdens.

Recognizing these pitfalls before they strike protects you from costly mistakes that benefit insurance companies at your expense.

Believing collision damage waiver covers everything leads to shock when liability claims arrive, while assuming credit card coverage automatically protects you ignores the fine print excluding most real-world scenarios.

Reading rental contracts might seem tedious, but missing crucial clauses that void coverage for common situations like driving on unpaved roads costs thousands.

Accepting blame or making statements at the accident scene creates permanent ammunition for insurance companies to use against you across multiple claims.

When dealing with how insurance companies handle car accident claims, every word matters more in rental situations where multiple insurers seek any excuse to deny coverage.

Step-by-Step: What to Do After a Rental Car Accident in Texas

Taking the right steps immediately after a rental car accident protects your legal rights and prevents insurance companies from exploiting confusion.

Following this proven process helps Angel Reyes & Associates build strong cases that overcome the unique challenges rental car accidents create.

First, ensure everyone’s safety and call 911 for police and medical response, creating official documentation that all insurance companies must acknowledge.

Document everything thoroughly including photos of all vehicles, the rental agreement, insurance cards, and witness information. This evidence that becomes crucial when insurers dispute facts later.

Never admit fault or discuss the accident beyond basic information with police, especially when multiple insurance companies will scrutinize every statement for advantage.

Notify the rental company following contract requirements but avoid detailed statements until consulting an attorney who understands these complex insurance interactions.

Review all your insurance policies and credit card benefits before filing any claims, as the order and method of filing can dramatically impact coverage.

Most importantly, consult a Texas accident attorney immediately. When insurers start pointing fingers, early legal intervention prevents costly mistakes and ensures maximum recovery.

And we provide critical guidance for what to do after a car accident.

FAQs About Rental Car Accidents and Insurance in Texas

What happens if I crash a rental car in Texas?

Your liability depends on fault determination, available insurance coverage, and specific rental contract terms that might void protection.

You could face responsibility for vehicle damage, injury claims, or both if coverage gaps exist or insurers successfully deny claims.

Does my personal auto insurance cover rental cars?

Most personal policies extend some coverage to rental cars, but often only for liability and frequently as secondary coverage behind rental company insurance.

Check your specific policy language, as many exclude damage to the rental vehicle itself or have territorial limitations.

Can the rental company be held responsible for the accident?

The Graves Amendment typically protects rental companies from liability unless they were negligent in vehicle maintenance or safety compliance.

Proving rental company negligence requires showing specific failures like ignoring recall notices or renting vehicles with known defects.

Will my credit card cover rental car damage in Texas?

Credit card coverage varies dramatically by issuer and card type, with most providing only secondary collision coverage that excludes liability entirely.

Many cards also exclude trucks, luxury vehicles, or rentals exceeding 30 days, making careful review essential before relying on this protection.

Should I talk to the other driver’s insurance company?

Never provide statements to any insurance company without legal counsel, as adjusters use these conversations to shift blame and minimize payouts.

This becomes even more critical in rental car accidents where multiple insurers seek any advantage. Understanding whether to talk to the other driver’s insurance company protects your claim.

Why Legal Guidance Matters in Texas Rental Car Accidents

The intersection of multiple insurance policies, complex rental agreements, and Texas liability law creates a perfect storm where victims often receive nothing despite having multiple supposed protections.

Insurance companies count on this confusion, knowing most people give up when faced with denials from several insurers simultaneously.

Angel Reyes & Associates cuts through this deliberately complex system by forcing each insurer to acknowledge their responsibilities while preventing them from hiding behind each other.

We understand every escape clause these companies use and know exactly how to close those loopholes that leave victims stranded.

Don’t let insurance companies exploit rental car confusion to deny your rightful compensation. Request a free consultation with Angel Reyes & Associates today.