PIP vs MedPay vs UM/UIM in Texas: A Practical Guide

The medical bills are arriving after your wreck on I-35. Your insurance company mentioned PIP and MedPay, but you are not sure which coverage pays what or whether you have enough.

Texas law requires insurers to offer you PIP coverage starting at $2,500, but that does not mean you have it or that it covers everything. Sorting out which policy pays what can feel overwhelming when you are also dealing with pain and missed work. PIP, MedPay, and UM/UIM serve different purposes—and you may have all three without knowing it.

Understanding the Coverage Types

PIP (Personal Injury Protection) pays medical bills, lost wages, and some household services regardless of who caused the crash. It applies to you, your passengers, and sometimes family members. Texas insurers must offer PIP, but you can reject it in writing.

MedPay (Medical Payments coverage) pays medical expenses only. It does not cover lost wages or household help. Like PIP, it pays regardless of fault.

Some insurance claims require you to prove the other driver was at fault. PIP and MedPay do not. Both coverages sit on your own policy, and you do not wait for the other driver’s insurer to accept blame before these kick in.

PIP vs MedPay: How They Interact

PIP is broader. It covers medical costs plus up to 80 percent of lost income and up to $25 per day for household tasks you cannot perform while recovering.

MedPay is narrower but sometimes cheaper. If your policy has both, you may be able to use them together, though some policies coordinate benefits to avoid double payment.

Check your declarations page. If you see “PIP rejected” in writing, MedPay might be your only first-party medical coverage. If you never signed a rejection, you likely have at least the $2,500 minimum PIP.

A quick call to your agent or a free consultation with an attorney can confirm what you actually carry. That clarity matters before bills start piling up.

UM/UIM in Texas

PIP and MedPay cover your immediate bills regardless of fault. But what happens when the other driver caused the crash and cannot pay? That is where UM and UIM come in.

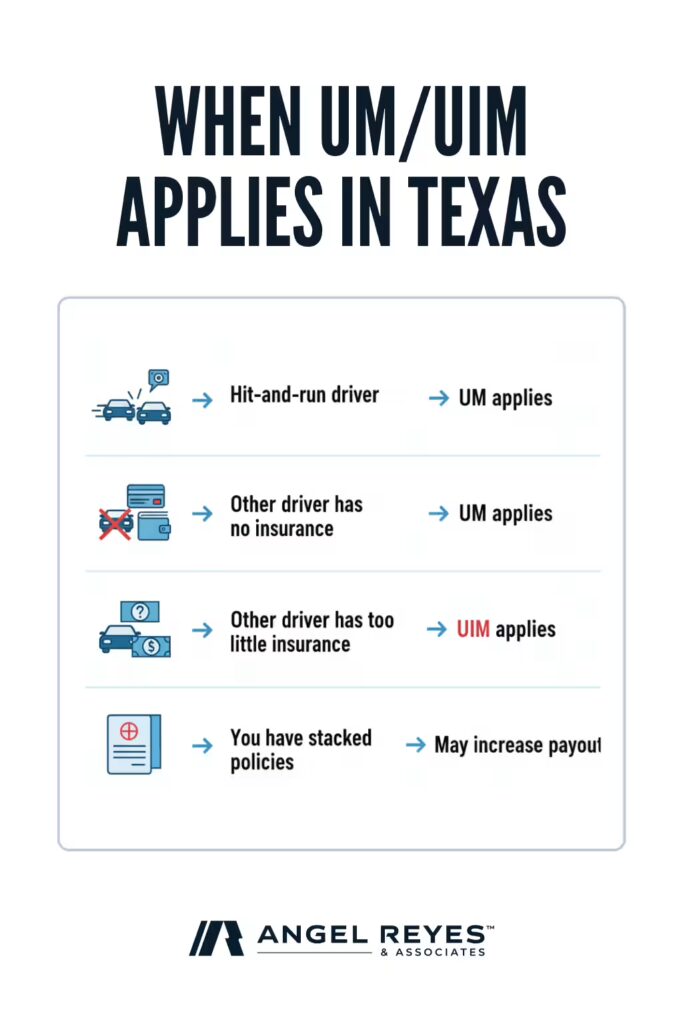

UM (Uninsured Motorist) coverage protects you when the at-fault driver has no liability insurance at all. UIM (Underinsured Motorist) coverage applies when the at-fault driver’s policy is too small to cover your damages.

Texas requires insurers to offer UM/UIM, but you can decline it in writing. If you did not sign a waiver, you likely have it. These coverages are fault-based—you file a claim against your own UM/UIM policy, but you still must show the other driver caused the crash.

When UM/UIM Applies

UM applies in hit-and-run crashes or when the other driver carries zero liability coverage. About one in eight Texas drivers is uninsured, according to the Insurance Research Council (2023), so this scenario is common on Houston’s 610 Loop or Dallas’s LBJ 635.

UIM applies when the at-fault driver’s policy maxes out below your total damages. Texas minimum liability is only $30,000 per person, which rarely covers a serious injury with surgery, rehab, and months of lost wages.

If you carry UM/UIM on multiple vehicles, you may be able to combine those limits—a process called stacking. Stacking can double or triple your available recovery. Review your policy language or ask an attorney whether stacking applies to your situation.

Decision Guide: Which Coverage to Rely On After a Crash

Knowing what you have is the first step. Knowing the order of payment is the second. Generally, PIP and MedPay pay first, your health insurance fills gaps, and UM/UIM comes into play when the at-fault driver cannot cover your damages.

Step 1: Identify available coverages on your policy.

Pull your declarations page. Look for PIP, MedPay, UM, and UIM line items. Note the dollar limits. If you rejected PIP or UM/UIM in writing, those lines may show zero or “declined.”

Step 2: Assess gaps and potential out-of-pocket exposure.

Add up your current medical bills and estimate future treatment. Compare that total to your coverage limits.

If your MedPay is $5,000 but your ER visit alone was $12,000, you have a gap. Health insurance can help fill that gap, but planning how multiple policies interact takes careful timing.

Step 3: Plan your claim strategy.

File PIP or MedPay claims early. They pay quickly and do not require proving fault.

If the other driver was at fault and underinsured, notify your own insurer of a potential UIM claim. Texas has a two-year statute of limitations for personal injury claims, so do not wait until the deadline approaches to start this process.

An attorney can coordinate benefit timing and help you keep more of your recovery.

Angel Reyes & Associates has guided Texans through situations like this for over 30 years. Get a free consultation to review your options. Past results do not guarantee future outcomes.

PIP vs Medpay vs UM/UIM FAQs

What does PIP cover in Texas?

PIP covers reasonable medical expenses, up to 80 percent of lost income, and up to $25 per day for essential household services you cannot perform while recovering. It pays regardless of fault.

Is MedPay worth it in Texas?

MedPay can be worth it if you want a low-cost way to cover immediate medical bills without waiting on fault determinations. It is narrower than PIP but often cheaper. If you already have strong health insurance and PIP, MedPay may be redundant.

Do UM/UIM policies stack with other coverages?

Texas law may allow stacking of UM/UIM limits across multiple vehicles on the same policy, depending on policy language. Stacking does not apply to PIP or MedPay. Review your policy or consult an attorney to confirm whether your UM/UIM limits can be combined.

How do hospital liens affect my settlement?

Under the Texas Hospital Lien Act, a hospital can place a lien on your personal injury recovery for unpaid charges. This lien attaches to any settlement or judgment you receive. An attorney can sometimes negotiate the lien amount down, which increases what you keep.

When should I contact an attorney about my coverage?

Contact an attorney if your medical bills exceed your PIP or MedPay limits, if the at-fault driver is uninsured or underinsured, or if you receive a subrogation notice from your health insurer. Early legal guidance helps you avoid mistakes that reduce your recovery.

Next Steps After a Texas Crash

Pull your declarations page today. Confirm whether you have PIP, MedPay, and UM/UIM—and note your limits for each.

If your bills already exceed your first-party coverage, or if the at-fault driver lacks adequate insurance, you may have a gap that requires legal strategy to close. Acting early protects your options before deadlines pass.

We’ve guided Texans through situations like this for over 30 years. Get a free consultation to review your options. Every case is different; past results do not guarantee future outcomes.