Why Texas Insurance Adjusters Push Quick Settlements

You’re still sore from a wreck on I-35 when the adjuster calls with a settlement offer that expires Friday. You might be panicked and feel you have no choice but to accept, but the truth is this is what the insurer hopes you will think. The offer might sound reasonable while you’re juggling doctor visits and missed shifts. But adjusters are trained to close files fast and cheap.

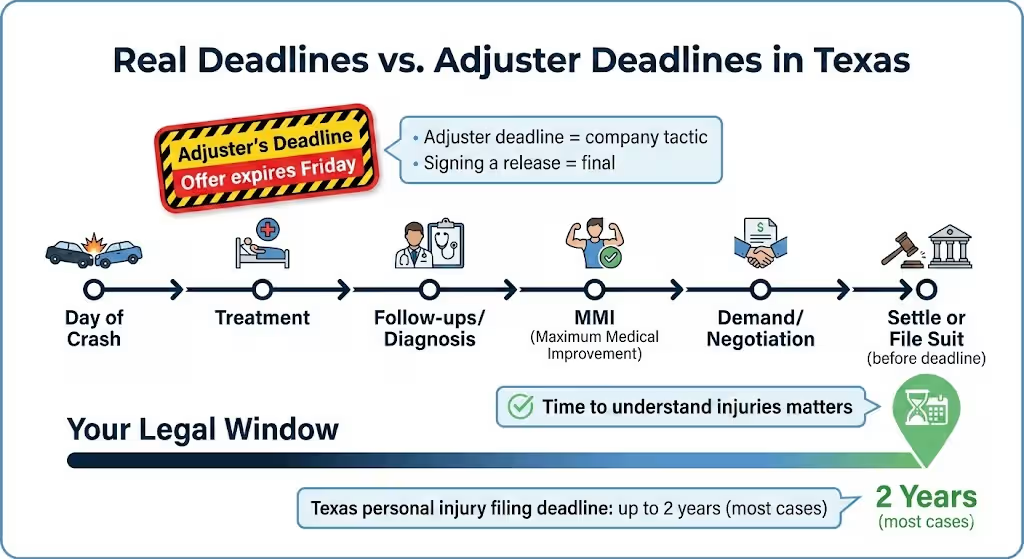

Texas law gives you up to two years to file a personal injury lawsuit, so that rushed deadline serves the insurer, not you. Insurance companies want to close cases as quickly as possible and for as little as possible, and understanding why helps you protect your claim and your future.

How Quick Settlements Benefit Insurance Companies

Insurance adjusters work for the company that writes their paycheck, not for you. Their job performance often ties directly to closing claims quickly and for as little as possible. They also know that injured Texans facing rent, car repairs, and ER co-pays often feel pressure due to budget constraints, which serves as a strong motivation to take whatever cash is available now.

However, once you sign a release, you give up the right to ask for more money. A fast settlement locks in your compensation before you potentially know the full cost of your injuries. However, the insurer’s file is already closed, so any remaining out of pocket costs are your responsibility.

Risks of Settling Too Early

Accepting a quick settlement insurance offer can cost you in ways that aren’t obvious at first. Here are a few reasons why we strongly recommend against settling early:

- Medical bills you don’t know about yet. Some injuries, like herniated discs or traumatic brain injuries, take weeks or months to fully diagnose. A settlement signed before you reach maximum medical improvement may leave you paying out of pocket for future treatment.

- Lost wages and earning capacity. If your injury affects your ability to work long-term, an early offer probably won’t account for that.

- Pain and suffering. Texas allows compensation for physical pain, mental anguish, and reduced quality of life. Quick offers rarely reflect these damages accurately.

Remember: a signed release is final. You cannot reopen the claim if your condition worsens or new expenses arise. For a deeper look at evaluating offers, see Should I Accept the Insurance Settlement Offer?

Common Adjuster Pressure Tactics

Recognizing these pressure tactics that insurance adjusters engage in helps you slow down and make informed decisions. Do not feel obligated to accept any settlement that comes with any of the following stipulations:

- Artificial deadlines. Saying something like “This offer expires Monday” at 5 P.M. on Friday creates panic. In most cases, no law requires you to respond within just a few days’ notice.

- Downplaying injuries. Adjusters may suggest your pain is minor or requires less treatment, hoping you’ll accept less compensation.

- Friendly tone, strategic questions. A conversational call might include questions designed to get you to admit fault or minimize your symptoms. Anything you say can be used to reduce your payout.

- Delaying paperwork, then rushing you. Some insurers drag out requests for documents, then suddenly demand a quick decision once you’re exhausted.

- Surveillance. Adjusters sometimes monitor social media or even hire investigators to find posts or footage that contradict your injury claims.

If an adjuster’s behavior feels pushy or confusing, trust that instinct. You can pause, gather information, and consult an attorney before responding.

How to Protect Yourself Before Responding

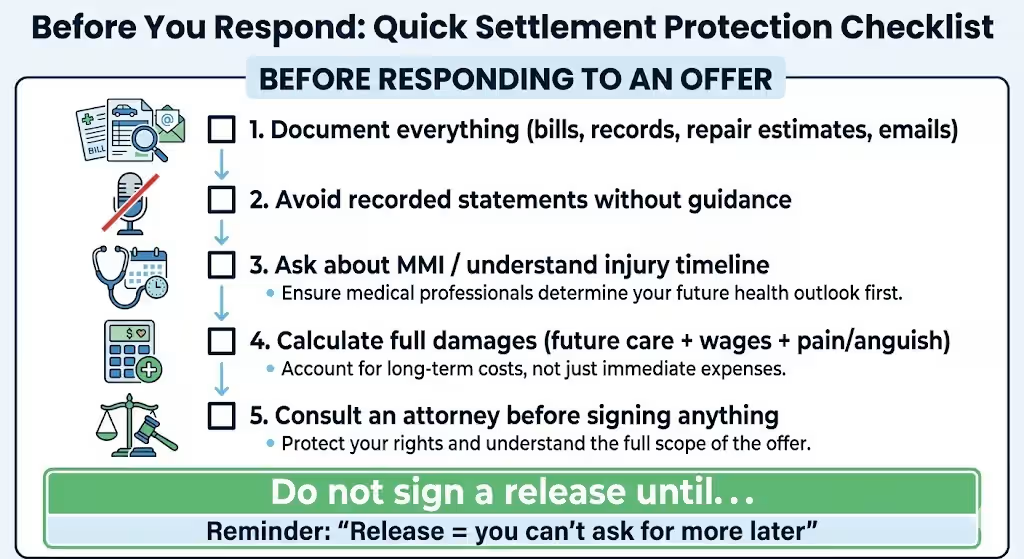

You don’t have to say yes or no on the spot to any offer. Following these steps can help you respond from a position of knowledge, not panic:

- Document everything. Keep copies of medical records, bills, repair estimates, and any communication with the insurer.

- Avoid recorded statements without guidance. Adjusters may ask to record your account of the accident. You’re not required to agree, and what you say can be used against you.

- Wait until you understand your injuries. Ask your doctor when you’ll reach maximum medical improvement. That timeline matters more than the adjuster’s deadline.

- Calculate the full scope of damages. Include future medical care, lost earning capacity, and non-economic losses like pain and mental anguish.

- Consult a personal injury attorney. A lawyer can review the offer, identify what’s missing, and negotiate on your behalf. Most Texas personal injury attorneys, including Angel Reyes & Associates, work on contingency, meaning no upfront fees.

For more on how insurers handle claims, read How Insurance Companies Handle Car Accident Claims in Texas.

When to Get Legal Help

If your adjuster’s offer feels low, the deadline feels rushed, or your injuries are still being treated, it’s worth talking to an attorney before you sign anything.

At Angel Reyes & Associates, we have guided injured Texans through insurance negotiations for over 30 years. We proudly offer free consultations that let you review your options, understand what your claim may be worth, and decide your next step with clear information.

You deserve to make this decision with full knowledge of what you may be giving up. Call us or use our contact form to reach out today.

Quick Settlement FAQs

Can I negotiate with the adjuster myself?

You can, but remember: adjusters negotiate claims for a living. An attorney levels the playing field and often helps recover more than the initial offer, even after fees. If you’re unsure, a free consultation can give you a clearer picture.

What if I already gave a recorded statement?

One statement doesn’t end your claim. However, we recommend avoiding additional recorded conversations until you’ve spoken with an attorney who can advise you on next steps.

How long do I actually have to decide?

Texas has a two-year statute of limitations for most personal injury claims. Adjuster-imposed deadlines are usually negotiable. Don’t let artificial urgency push you into a decision you’ll regret.

What if I need money now for bills?

Financial pressure is real, and insurers know it. Some attorneys can help you access medical treatment on a lien basis, meaning providers wait for payment until your case resolves. Ask about options before accepting a low offer just to cover immediate costs.